Why should I donate to IDRF?

When talking with Dr. Prakash about why I should donate to IDRF, he answered that.

- As a founder and full-time volunteer of IDRF, he firmly believes that serving his motherland is his (and every Indian's) duty and moral responsibility.

- He insists that the fortunate Indians with a well-settled life in the USA should contribute whatever they can for their community, cause, or motherland. Their little contribution will be helpful to give better education and thus a better future to poor children of India.

- IDRF aims to find innovative ways to help poor children in India and make them capable by giving them a proper education.

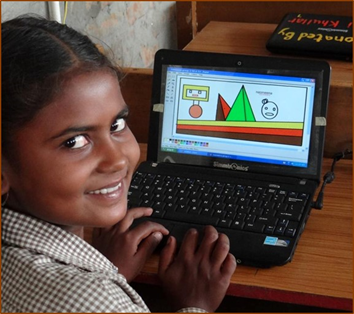

- IDRF team believes that technology adoption is essential for the efficient growth of children. For this, they have partnered with an NGO, Computer Shiksha, which works in several states of India.

Through this NGO, IDRF provides free computer literacy and digital skills from beginners to advanced level to underprivileged children and youth in 20 states of India. IDRF team believes that technology adoption is essential for the efficient growth of children. For this, they have partnered with an NGO, Computer Shiksha, which works in several states of India.

Through this NGO, IDRF provides free computer literacy and digital skills from beginners to advanced level to underprivileged children and youth in 20 states of India.

In addition, he added several reasons to ensure that IDRF, is one of the leading nonprofits in the USA that supports the less fortunate in India.

For prospective donors looking for tax-exempt donations, IDRF is one of the most reliable platforms. Further, he mentioned that IDRF’s overhead costs are very low, and this ensures that the beneficiary NGOs get the maximum benefits of the donations. IDRF respects it’s donors’ desire to help their communities with different causes, like health for rural poor, education for poor girls, and women empowerment, etc. .

- IDRF respects donors’ preferred NGOs for any projects or causes, but never compromises the quality of its services. The NGO must meet Indian and US legal standards. It means, it is essential to have an FCRA registration for the organization to receive funds from IDRF. If the organization has no FCRA, IDRF even helps them to apply for registration without any charges, as mentioned by Dr. Prakash.

- Moreover, in case donors cannot decide the cause to utilize their donation for when they donate money, IDRF has an option for that too- donor-preferred funds (DPF). The donor makes a donation and gets an immediate tax exemption and then recommends grants from the funds over time to the

charity/cause/state of his/her choice. - Thus, with a transparent and ethical work approach, IDRF also provides flexible choices to donors for utilizing their donations within their focused areas. At IDRF, the donation reach the needy people for the appropriate purposes, said Dr. Prakash.